by NFTLZ.ETH(@defiandnft)

中文版:BendDAO 2.0 愿景 — NFTLZ.ETH

This is a personal vision of the future development of BendDAO, not an official development roadmap.

We hope to hear from more people about the future development of BendDAO.

BendDAO Vision

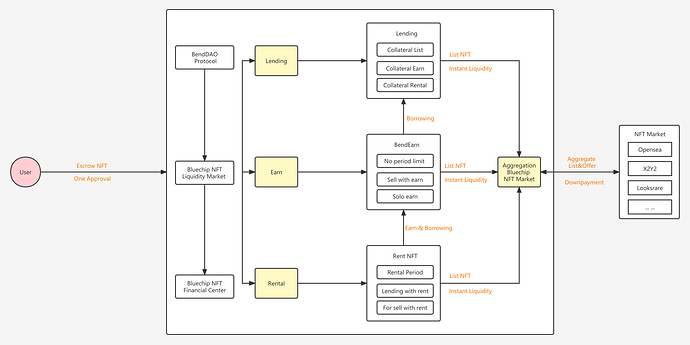

Deposit NFT into BendDAO , you can do anything you want.

- With instant liquidity and down payment purchases, BendDAO has become a major liquidity market for blue chip NFTs.

- The decentralized NFT escrow model, the integration of Earn and Rental, allows users to operate on NFT at the lowest cost.

- In the future, through the development of NFT derivatives, BendDAO will be established as a blue-chip NFT financial center.

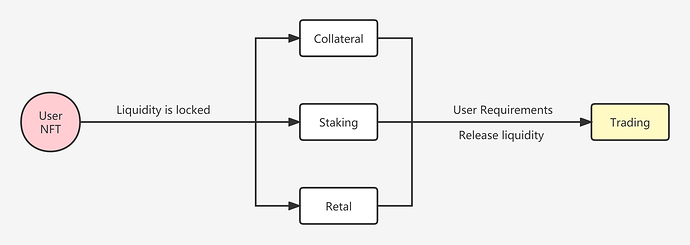

User Requirements

- Users need to lock in liquidity in order to Earn, which is not good for the overall market.

- BendDAO releases liquidity while Earn.

- In addition to releasing liquidity, liquidity needs to be pushed to all NFT markets.

Deposit NFT into BendDAO

Get Instant Loans

Get Airdrop

Get staking earnings

Get rental income

At the same time, it is possible to trade these Collateral and Staking NFTs in all NFT markets. even NFTs in lease can be traded without breaking the lease.

Deposit NFT into BendDAO, let NFT make its proper value.

Abstract

- Establish a blue-chip NFT aggregation exchange market and complete the construction of a closed-loop blue-chip NFT ecosystem.

- Adjusting the Tokenomics, with community governance leading the incentive and release of tokens,Make veBEND have more use scenarios.

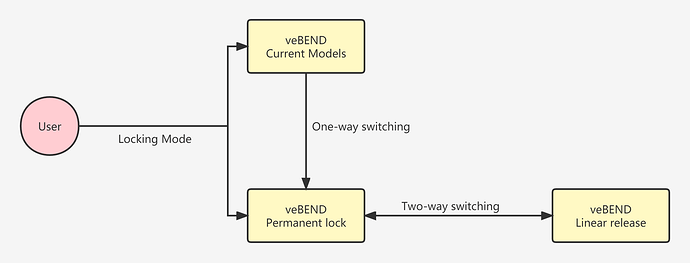

- Adjust the veBEND model so that veBEND can be switched from permanent lock mode to linear release mode.

Blue Chip NFT Aggregate Exchange Marketplaces

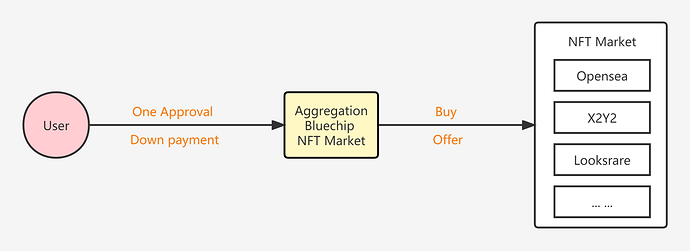

1. Buy

BendDAO’s aggregated exchanges demonstrate to users the liquidity of the major NFT marketplaces, with a user experience that feels similar to Blur.

- Users need only one approval to trade in all NFT markets.

- Down Payment supports all NFT markets.

- Down Payment supports Offer.

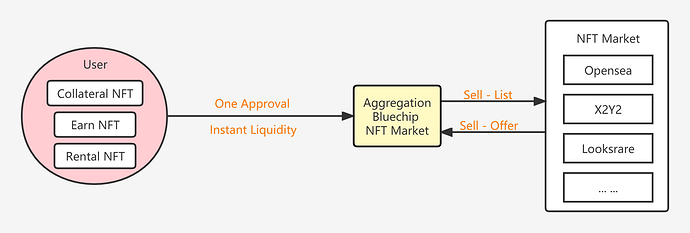

2. Sell

BendDAO lists users’ NFTs to major marketplaces and aggregates offers from major marketplaces.

- Collateral NFT and Earn NFT can be traded on major marketplaces.

- Rental NFT can only trade with rent within BendDAO as it is not possible to cancel the lease.

- Instant liquidity is available for all NFTs on the list.

Tokenomics

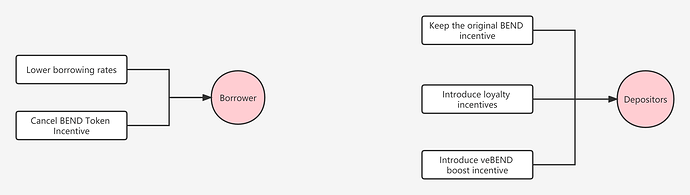

1. BEND Token Incentive adjustment

- Lower borrower costs and lower the amount of BEND tokens released daily.

- Introduce multiple incentive models to motivate depositors and increase depositor rewards.

- Increase the usage scenarios of veBEND.

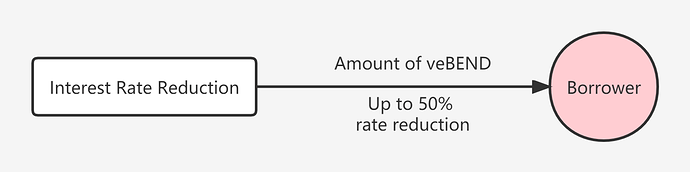

2. veBEND Usage - Interest Rate Reduction

- Holding veBEND can reduce borrowing rates.

- The BEND/ETH exchange rate, the amount of debt, and the amount of veBEND are used to determine the interest rate that can be borrowed at a discount.

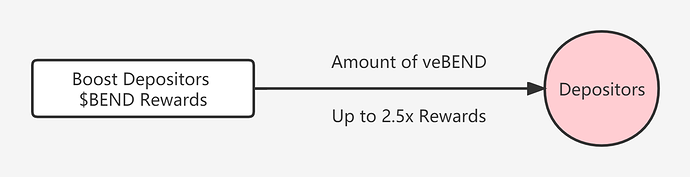

3. veBEND Usage - Boost Depositors $BEND Rewards

- Hold veBEND to get the Boost reward, the same as Curve’s LP Boost.

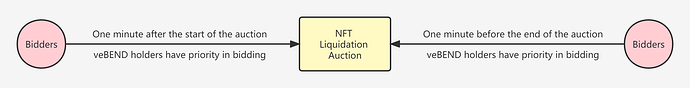

4. Auction priority

- veBEND holders have priority to bid at the auction after the start and before the end of the auction for one minute.

- The BEND/ETH rate,veBEND amount, will determine the number of ETH with priority bids.

The veBEND Model

1. Lock mode switching

- No new locking tokens are proposed for the current model

- Users can switch between permanent lock and linear release

- Permanent lockout switching to linear release requires payment of a penalty.

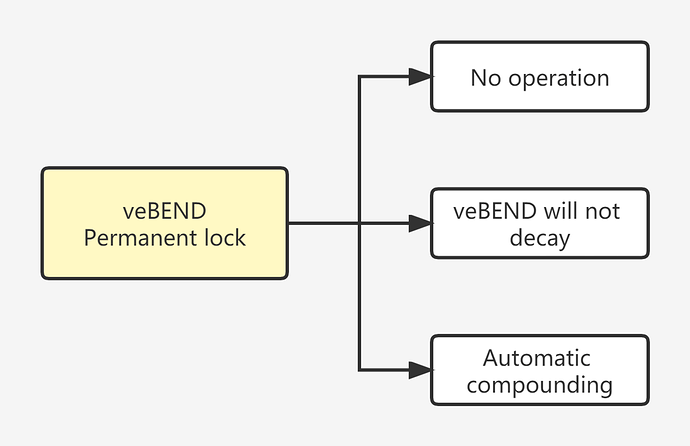

2. Permanent lock

- Users no longer need to frequently roll over their locks

- The number of veBEND will not decay, and will increase if automatic compounding is selected.

- The current user will also receive a fee for other users to exit the permanently locked model.

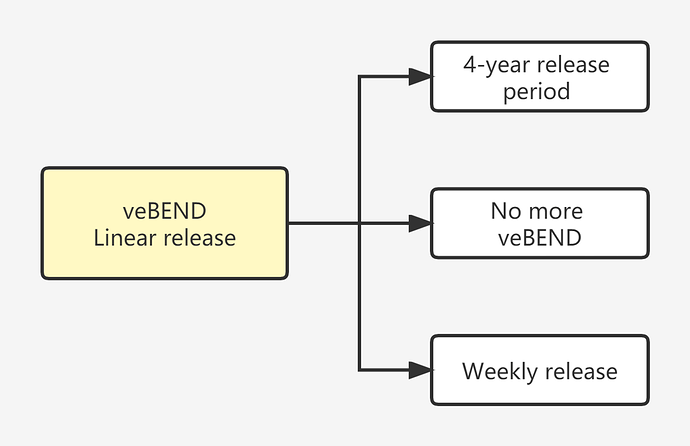

3. Linear release

- Any number of veBENDs can be switched to linear release mode.

- The release period for linear release mode is 4 years, based on the last switching time.

- The same number of BENDs are released each week.

- Switching destroys veBEND

End

The above is a personal opinion and does not represent official advice.

For the future development of BendDAO, a consensus between the community and the team is needed, as well as a community authorization for the use of the treasury.