BIP: #31

Title: Reward BEND tokens to users participating in ApeStaking V2

Idea(BRC):Discord

BIP by: NFTLZ.ETH#0717

Created: 2023-05-31

Status: Community Review

BIP Editor: NFTLZ.ETH#0717(**@**defiandnft)

Abstract

Proposal for BEND token rewards for ApeStaking V2 users. Three main plans have been collected:

Plan A: Calculate user loyalty and distribute rewards based on loyalty.

Plan B: Calculate the proportion of asset share to total share, similar to the lending reward method, with three different share calculation methods:

- NFT shares are equal to APE token shares, i.e. 1NFT = the number of APE tokens paired with it. For example, 1BAYC is calculated as 10094 APE tokens.

- Calculate shares dynamically based on the official staking pool’s APR. Based on the current APR, 1BAYC is approximately equal to 10094 X 3 APE tokens.

- Calculate shares dynamically based on the official staking pool’s APR, only rewarding NFTs.

Plan C: Gas fee subsidy activity for users using ApeStaking V2.

The following are detailed information on the three plans:

I will collect community members’ suggestions for improving BIP#31 and answer any questions regarding this proposal.

Plan A

Background

On December 5th, 2022, Yuga Labs officially launched its APE asset staking activity with the help of Horizen Labs.

ApeStake.io is the official staking protocol for ApeCoin ($APE) established by the ApeCoin DAO (ApeDAO) and was created as a way for $APE, BAYC, MAYC, and BAKC holders to earn rewards through staking. $APE can be staked by itself or in conjunction with a BAYC, MAYC, or BAKC in one of the four staking pools, with each pool offering different levels of rewards.

BendDAO launched the paired staking feature for ApeStaking on December 11, 2022, allowing NFT holders to pair with APE token holders. Upon successful pairing, BendDAO protocol will deposit the assets into apestake.io for staking.

Since the launch of the paired staking feature, BendDAO team has been collecting feedback from the community. Based on market research and user feedback, they have developed V2 of ApeStaking which includes:

- Pool-to-pool automatic pairing

- Automatic compounding

Users do not need to pay any gas fees for pairing or compounding and do not need to perform any operations. Simply deposit assets into BendDAO and all other actions will be automatically completed by the BendDAO protocol.

Motivation

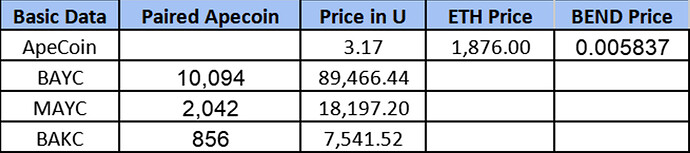

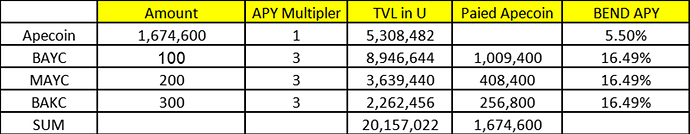

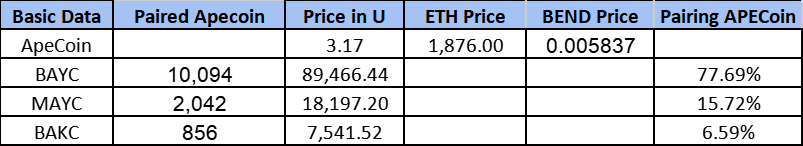

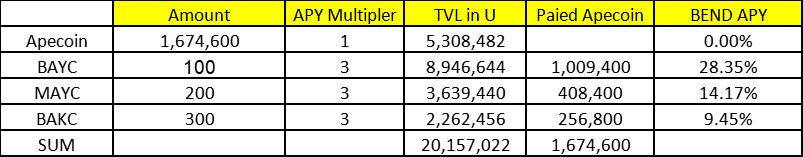

BendDAO aims to provide paired staking services for ApeStaking users. As of May 23, 2023, the assets for ApeStaking’s paired staking are as follows:

Meanwhile, the protocol charges a 4% service fee on each staking income, and the treasury has received approximately $350K in service fees.

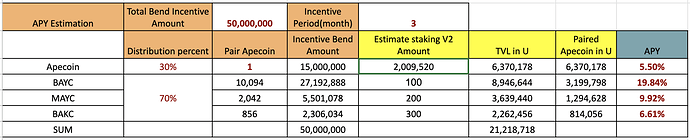

As Yugalabs’ ApeStaking activity will last for three years, during which new projects serving ApeStaking will continue to be launched. In order for BendDAO to seize more market share of ApeStaking and bring more revenue to the protocol, it is recommended that BEND token incentives be given to users who use ApeStaking V2 after its launch.

Proposal

Incentivize users with tokens based on their loyalty, using the season as a cycle.

Basic Information

Incentive Token: BEND

Source: BendDAO Treasury

Incentive Cycle: Season 1, lasting for 3 months + 1 week

Eligible Users for Incentives: Users who use ApeStaking V2 during Season 1

Token Release Schedule: The incentive tokens will be released linearly over a period of 6 months after the end of Season 1.

Incentive Rules

A points system is used, and at the end of each season, the total points earned by each user are calculated. The number of BEND tokens that can be obtained is determined based on the proportion of individual points to total points.

How to earn points:

Users can earn points by depositing NFT or APE tokens into ApeStaking V2.

How are points calculated:

- Users’ basic shares are calculated in APE tokens, while NFTs are calculated based on the number of paired APE tokens. For example: 1 BAYC = 10094 APE.

- Users holding veBEND can receive bonus points. To receive a bonus for every 1 APE deposited, users must hold 10 veBEND.

- The longer the deposit time, the higher the bonus point multiplier.

Bonus point multipliers (based on asset deposit time):

- Deposits held for 90 days or more will be multiplied by 2.

- Deposits held for 60-89 days will be multiplied by 1.5.

- Deposits held for less than 60 days will be multiplied by 1.

- Holding a corresponding amount of veBEND earns an additional 0.5x multiplier.

- Points = deposited APE quantity x duration x (duration multiplier + veBEND multiplier).

| Period(days) | Points Bonus | Hold veBEND |

|---|---|---|

| <60 | X 1 | + 0.5 |

| >60 and <90 | X 1.5 | + 0.5 |

| >90 | X 2.5 | + 0.5 |

Test Cases

Case 1. Deposit 10,000 APE tokens without using auto-compounding, with a deposit time of more than 3 months and holding 100,000 veBEND tokens. The total points earned will be 2,250,000 (10k tokens x (2+0.5) x 90 days), considering the bonus for holding veBEND tokens.

Case 2. On day one, deposit 10,000 APE tokens without using auto-compounding. On day ten withdraw 5,000 APE tokens and on day thirty deposit another 7,000 APE tokens until the end of the event. The total points earned will be 1,580,000 ((10k-5k)x2x90 +5000x1x10 +7000x1.5x60).

Use auto-compounding and calculate the number of tokens deposited each time along with their respective duration.

Token Quantity

BIP#31 only discusses the incentive plan. If it is approved, we need to apply for the amount of Bend required in the incentive activities of Season 1.

Incentives for V1 Users

Whether to reward V1 users and how to do so is not discussed in this proposal. I will initiate a separate proposal to discuss compensation or incentives for V1 users.