Draft to increase BAYC collateral rates

Simple Summary

It is proposed to increase the collateral ratio for Bored Ape Yacht Club (BAYC) collateral from 40% to 50%.

Abstract

This proposal includes the following elements:

-

Increasing the collateralization rate of BAYC can improve the utilization of depositors’ funds.

-

The relationship between collateral rates and liquidation auctions.

-

The effect of increasing collateral rates on BendDAO?

Motivation

BendDAO is a peer-to-pool model NFT lending platform, and the Protocol uses the over-collateralization method to provide services to both lenders and borrowers.

At the initial stage of the Protocol’s creation, in order to correspond to the systematic risk of NFT, so the Protocol set the collateralization rate of NFT at 30-40%, i.e., the collateral value of 100E NFT can borrow 30-40 ETH.

Such a collateral rate setting served to stabilize the protocol in the early stages of development, but a collateral rate of 30%-40% also resulted in relatively low asset utilization for both lenders and borrowers.

As the development of the NFT market becomes more and more mature, the stability of blue-chip NFT is also increasing, so I propose to increase the collateral rate of the leading NFT project BAYC from the original 40% to 50%, the purpose of doing so is to further improve the asset utilization rate of both lenders and borrowers, within the scope of risk control, to provide maximum benefits for both lenders and borrowers.

Risk Analysis

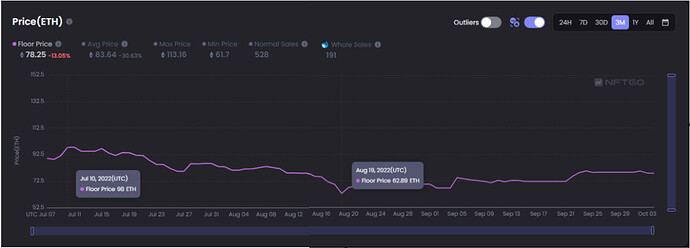

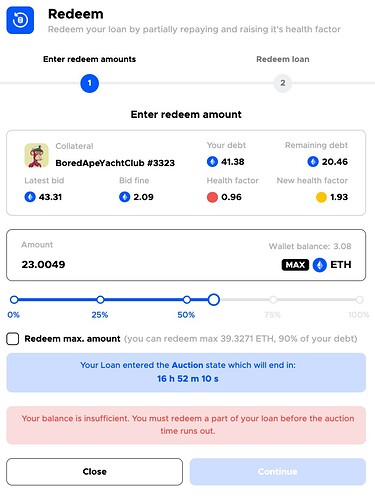

Let’s look at the floor price of BAYC in the last 3 months, the highest price was July 10, 98E, and the lowest price was August 19, 62.89E.

Based on Health Factor = (Floor Price * Liquidation Threshold) / Debt with Interests, we can calculate.

80% Liquidation Threshold remains unchanged, and the impact of different collateralization rates on the liquidation trigger when collateralized at the highest price of 98E.

- 40%:borrowed 98E X 40% = 39.2E, liquidation price: 39.2E/80% = 49.00E.

- 50%:borrowed 98E X 50% = 49.0E, liquidation price: 49.0E/80% = 61.25E.

- 60%:borrowed 98E X 60% = 58.8E, liquidation price: 58.8E/80% = 73.50E.

- 70%:borrowed 98E X 70% = 68.6E, liquidation price: 68.6E/80% = 85.75E.

- 80%:borrowed 98E X 80% = 78.4E, liquidation price: 78.4E/80% = 98.00E.

Different collateral ratios affect the price at which liquidation is triggered. When the collateral ratio reaches 80%, the liquidation price is the current price and the collateral will be liquidated immediately after collateral.

The lower the collateral ratio, the longer the liquidation trigger period, and the higher the collateral ratio, the shorter the liquidation trigger period.

The lowest price in the past three months was 62.89E, and neither 40% nor 50% collateral ratio triggered liquidation, which shows that the risk of 50% collateral ratio is not much different from 40%.

The liquidation trigger price for a 60% collateral rate is 73.5E, meaning that a 25% drop in the price at the time of the collateral will trigger liquidation. After the collateralization on July 10, the liquidation will be triggered on August 17 at a floor price of 71.69E, with a 37-day period.

The liquidation trigger price for a 70% collateral rate is 85.75E, which means that a 12.5% drop in price at the time of the collateral will trigger liquidation. A collateralization on July 10 will trigger liquidation at a floor price of 85E on July 23. If collateralized on August 16 at a floor price of 75.5E, liquidation will be triggered on August 19 at a floor price of 62.89E for a period of 3 days.

As you can see, a collateral ratio that is too high can lead to a mortgagor on the verge of liquidation. 60% is, relatively speaking, in a relatively safe range, and 50% is not much different from 40%.

Effect to BendDAO

Increasing the collateralization rate of BAYC from 40% to 50% would increase the asset utilization of BAYC borrowers in BendDAO by 25%, and the funding utilization of lenders would increase accordingly.

Subsequently, we can also evaluate other blue chip NFTs to determine if there is room to increase the collateralization rate.

This will have a very positive effect on the whole BendDAO ecosystem and the revenue of the protocol will go to the next level.

Ending

The above is a draft for community members to discuss. After the discussion forms a consensus, I will prepare a formal proposal and then submit it to snapshot for voting.