Title: Enable wstETH deposits and facilitate borrowing by NFT collateral holders

Idea(BRC): Discord

BIP by: NFTLZ.ETH#0717

Created: 2023-12-22

Status: Community Review

Thread Editor: NFTLZ.ETH#0717(**@**defiandnft)

Background

Two weeks ago, we initiated a proposal on the forum to support wstETH as a deposit asset and allow NFT collateral providers. The idea received 10 affirmative votes and has now entered the forum discussion phase.

Summary

This proposal will discuss the following:

- The stability of wstETH

- The liquidity of wstETH

- Whether to share interest with ETH

- Whether to support token incentives

- Base interest rates

Please leave a comment below the post for any other matters that need to be discussed.

Stability of wstETH

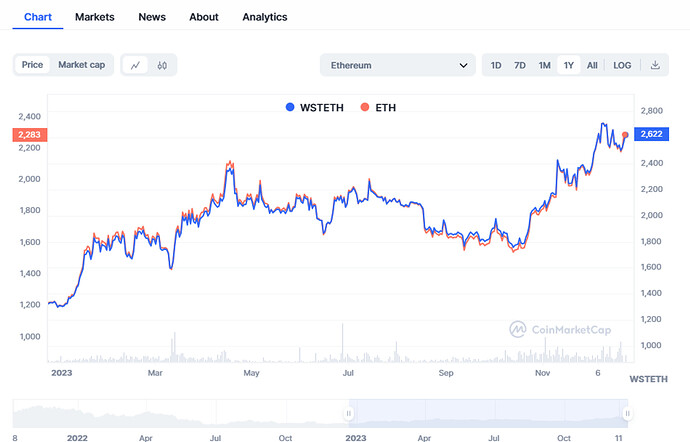

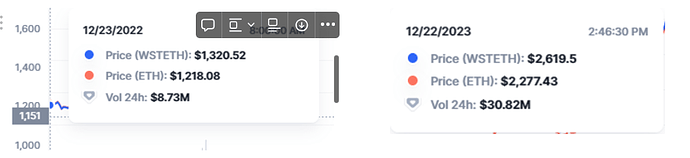

Over the past year, the exchange rate of wstETH to ETH has maintained a steady and slow upward trend due to the characteristics of wstETH.

The rate has risen from 1.09 to 1.14 over the past year, increasing by approximately 4.3%.

From the price relationship charts provided, it is evident that wstETH has maintained a certain ratio anchor to ETH without significant detachment.

Thus, we can conclude that wstETH has maintained a stable anchoring ratio with ETH over the past year.

Liquidity of wstETH

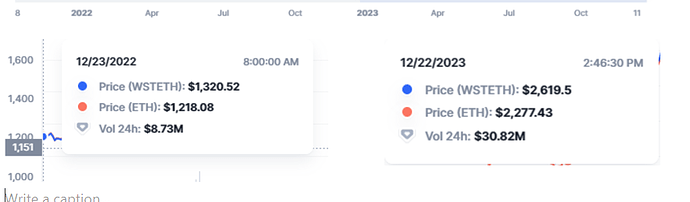

According to the graph, as of today, wstETH has issued approximately 3.2m tokens, with 7932 holders, and the market capitalization is about $8.4b based on the current price.

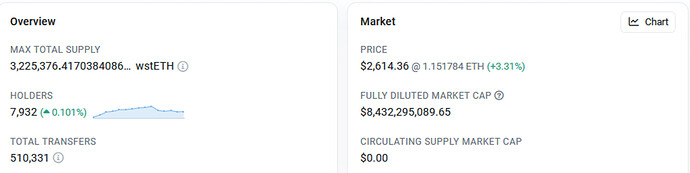

The trading volume of wstETH is mainly concentrated on-chain, with Uniswap and Balancer accounting for 50% of the total network volume.

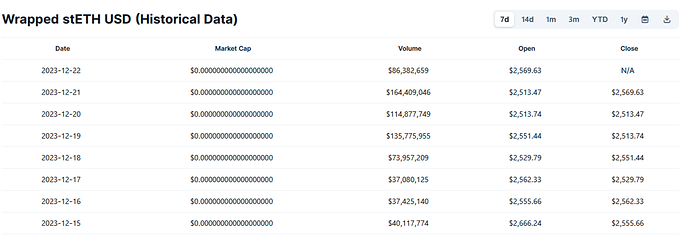

According to CoinGecko data, the wstETH has maintained a network-wide trading volume of over 30m over the past week, peaking at 160m.

Based on the above information, considering market capitalization, exchanges, and volume, we can conclude that wstETH has very strong liquidity and is very active in trading.

Base Interest Rates, Interest Distribution, and Token Incentives

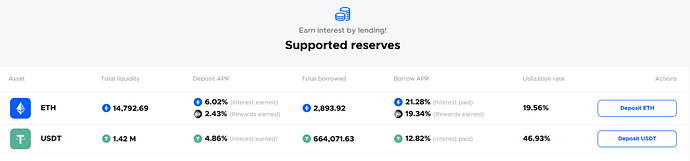

BendDAO protocol currently supports two types of deposit assets, ETH and USDT, each with its own independent interest rate calculation.

Although wstETH is anchored proportionally to ETH, the exchange rate is not 1:1; therefore, it is suggested that wstETH should also adopt an independent method for calculating base interest rates, interest distribution, and token incentives.

According to the latest BIP#44 proposal:

[BendDAO Proposal: BIP#44: Lower ETH Pool’s Base Rate and Protocol Admin Fee (snapshot.org)]

The base rate is: 12%

The interest distribution is: LP - 75%, Treasury - 25%.

No token incentives are provided for the time being.

背景

两个星期前我们在论坛发起了支持wstETH做为存款资产,并且允许NFT抵押者供出的Idea,获得了10个Pass,现在进入论坛讨论阶段。

摘要

在本提案中,我们将讨论以下内容:

- wstETH的稳定性

- wstETH的流动性

- 是否与ETH共享利息

- 是否支持代币激励

- 基础利率

需要讨论的其他事项,请在帖子后面留言。

wstETH的稳定性

以下是过去一年中,wstETH与ETH的价格关系图。

由于wstETH的特殊性,其与ETH的汇率一直保持稳步缓慢的上涨趋势。过去一年,汇率从1.09上升至1.14,上涨约4.3%。

从以上的价格关系图中,我们可以看出wstETH与ETH的价格一直保持着一定比例的锚定,并未出现过大幅脱锚的情况。

由此我们可以得出,wstETH与ETH在过年一年,保持着稳定的锚定比例。

wstETH的流动性

根据下图显示 ,wstETH截止今天,总共发行约3.2m代币,有7932个持有人,根据当前价格,市值约为$8.4b。

wstETH的交易量主要集中在链上,其中uniswap与balancer占据了全网成交量的50%。如下图:

根据coingecko的资料,wstETH过去一周,全网成交量都能保持在30m以上,最高达到160m。

根据以上信息,从市值,交易所,交易量来判断,我们可以得出结论,wstETH的流动性是非常强劲的,成交非常活跃。

基础利率、利息分配、代币激励

BendDAO协议现在支持两种存款资产,ETH和USDT,他们都是采用独立的利率计算方式。

虽然wstETH与ETH是按比例锚定,但是由于汇率并非1:1,所以建议wstETH也采用独立的基础利率计算方式、利息分配与代币激励。

根据最新的 BIP#44提案:

BendDAO Proposal: BIP#44: Lower ETH Pool’s Base Rate and Protocol Admin Fee (snapshot.org)

基础利率为:12%

利息分配方式为:LP - 75%, 国库 - 25%。

暂时不提供代币激励。

POLL

- Agree to introduce wstETH

- Oppose the introduction of wstETH

0 voters