This is my first time participating in BendDAO’s Governance, so please forgive any mistakes. Before going to the Proposal stage, I would like to start a discussion here in the General channel. Thank you in advance for your understanding and support.

Executive Summary

We put forth a proposal to implement a cross-chain lending solution for BendDAO, a pioneer in establishing an NFT liquidity protocol that offers immediate NFT-backed loans, allowing users to borrow ETH in exchange for NFT deposits. Our grant proposal focuses on introducing an enhanced functionality wherein users can leverage ETH from different blockchains, such as Optimism, using NFTs collateralized on Ethereum. This will be facilitated by Chainsight, making BendDAO an even more powerful and flexible platform for NFT-backed lending.

About Chainsight

Chainsight is an interchain layer purpose-built for data processing. It orchestrates the synchronization of event data and snapshots between Ethereum and Optimism, thereby stacking historical data atop the network.

Anyone can leverage this data for on-chain analysis with open logic, such as calculating an economic indicator. Further enhancing its versatility, Chainsight offers trustless data writing back to any chain, courtesy of Distributed Key Generation and Threshold Signature. Our vision for Chainsight is for it to emerge as a composable oracle network, wherein data can be handled effectively by anyone.

Website: https://chainsight.network/

By bringing Chainsight into the BendDAO ecosystem, we can offer enhanced cross-chain interoperability and data analysis capabilities, expanding the possibilities for NFT-backed loans and solidifying BendDAO’s position as a leading innovator in the DeFi space.

Technical Overview

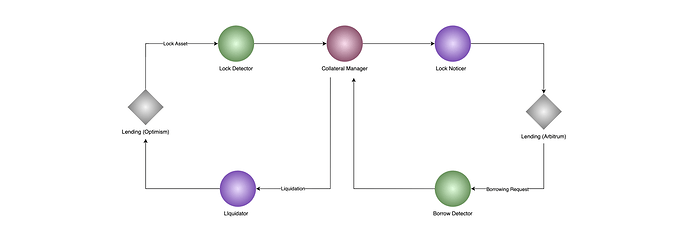

At the heart of Chainsight’s functionality lies its capability to manage cross-chain information in a completely trustless way. In the context of BendDAO, Chainsight facilitates the registration of user credit data based on the NFTs locked via BendDAO. This registered credit information is then shared with designated chains such as Optimism. Consequently, users gain the ability to borrow ETH on Optimism, using their credit as leverage. In the event of a collateral breach, Chainsight automates the liquidation process, triggering it to run from Chainsight back to the original chain.

The technical underpinnings of Chainsight can be summarized through three core functionalities:

- Monitoring events from Ethereum or other chain nodes.

- Storing data in the canister’s storage.

- Initiating transactions using Distributed Key Generation and Threshold Signature.

To better illustrate Chainsight’s components and their interactions, consider the following flow diagram:

In the spirit of transparency and collaborative design, we provide an open demo that simulates cross-chain lending. This fundamental design will serve as the basis for our collaboration with BendDAO, paving the way for future customizations specifically tailored to its needs.

Take a look at our demo: GitHub - horizonx-tech/demo-crosschain-lending: A demo for a cross-chain lending using chainsight

Incorporating Chainsight into BendDAO’s ecosystem not only enriches the technical foundation but also amplifies its potential to create novel financial structures in the NFT lending landscape.

Development Timeline

Our grant proposal is organized into two distinct phases, with each aligning with the increasing complexity of the planned functionalities.

Phase 1

Duration: July 1 - July 30

Grant Request: $10,000

Details:

In this initial phase, our focus is on the development and testing of core features. Chainsight will manage the credit available to a lender as a result of locking an NFT into BendDAO on Ethereum. If a borrowing request is received from another chain, Chainsight will verify the credit. If approved, the user can then borrow ETH on the other chain. A collateral manager within Chainsight will monitor the user’s credit. If it falls short, a liquidation process will be initiated on Ethereum by Chainsight. We will track the event that shows the credit held by each user on Chainsight.

Here is the line of code that we plan to track:

function createLoan(

address initiator,

address onBehalfOf,

address nftAsset,

uint256 nftTokenId,

address bNftAddress,

address reserveAsset,

uint256 amount,

uint256 borrowIndex

) external override onlyLendPool returns (uint256) {

require(_nftToLoanIds[nftAsset][nftTokenId] == 0, Errors.LP_NFT_HAS_USED_AS_COLLATERAL);

…

emit LoanCreated(initiator, onBehalfOf, loanId, nftAsset, nftTokenId, reserveAsset, amount, borrowIndex);

…

}

Upon the completion of these designs and implementations, we will present an integrated demo. This demo will require minimal to no modifications to the existing BendDAO contracts. If the demonstration proves to be practical and feasible, we will advance to the next step with mutual agreement.

We request a grant of $10K for this proof-of-concept milestone, payable upon grant approval.

Phase 2

Duration: Aug 1 - Aug 30

Grant Request: To be discussed

Details:

In the second phase, we will aim for a full-scale production implementation based on the demo from Phase 1. We will provide the necessary code and comprehensive support, including operation checks and emergency UI provision. The exact amount of the grant for this phase will be determined through mutual discussion, considering the scale and complexity of the tasks involved.

By fulfilling these milestones, we aim to bring significant enhancement to BendDAO’s ecosystem, expanding its capabilities in the NFT-backed lending space.

Team

Our team comprises skilled developers involved in the ongoing development of Chainsight. Each member brings a wealth of experience from a range of DeFi projects and Layer1 development teams, creating a powerhouse of blockchain technology expertise. Our group is further enriched by the inclusion of two renowned professors from prestigious universities who lend their knowledge in crafting a theoretical evaluation system that considers both economic indicators and financial data analysis.

We have been privileged to receive a developer grant and support from the DFINITY Foundation for ICP development, and we’re currently broadening our collaborations with promising DeFi protocols. Our plan to introduce Cross-Chain Lending for BendDAO leverages this collective experience and proficiency. Our goal is to significantly enrich the BendDAO ecosystem by introducing cross-chain capabilities, thereby bringing innovative functionalities to BendDAO’s user base and driving the platform’s growth further.