This is vs01.eth. I am a member of the benddao community and loyal supporter of benddao. I would like to express my views and questions here.

One of my questions is what is the background of the initiator of this new proposal? I only found out about this new proposal through the media in the benddao Chinese community. I asked the initiator, Guo Xinchen, Do we had the right to participate in the final vote as a vbend holder. His answer was that the vote would only decide the basic principles and the personnel of the financing team, but not affect the final investment agreement, mainly because the agreement involves quite a few specific parameters that would be fruitless if the community involved on the specifics. His answer made me wonder about his background, what was the background of the person who initiated this proposal? Why does he get to decide on the design of the specific parameters and not what the vbend shareholders decide? Does he represent the benddao project parties?

This is a very important question for me, if there is a need to raise funds, the specific parameters of this funding are the most crucial, as they are related to the core interests of every bend shareholder. vis.eth was the first to initiate this proposal, but the specific parameters of the new proposal initiated by Guo Xinchen are very different from those of vis.eth. This new proposal involves a huge number of bend tokens in circulation, and if it is not done properly, it will further undermine the bend project. If not properly issued, it will further undermine the confidence of bend holders and the community.

As we all know, the benddao first ifo offering, with its focus on community governance and fairness in the offering, is one of the representative projects of web3. In the offering, vis.eth was basically a packaged ifo. So most holders of bend tokens were purchased in the liquid pool after the ifo had completed. At this stage, the price of the token has fallen by over 90% from its peak, and has fallen below the ifo offering price. bend token holders have mostly made significant losses. One of the main reasons why community members were buying in large numbers on the secondary market at the time was that ifo had ended, and the benddao project has repeatedly stressed that there will be no more tokens to raise at low prices in their AMAs. So this financing, if the specific parameters details are not negotiated properly, will result in a significant increase in the circulation of low priced chips, which may disguise the harvesting of early bend holders and vbend shareholders, to the detriment of community unity.

I also have some observations about this proposal. bend did not add liquidity in its first ifo funding, and this time around it has no intention of adding liquidity in its plan to establish a distressed asset investment fund. Coupled with the fact that bend itself is a mining token and is being released every day, the selling pressure is growing every day. Next year, the project is going to unbind of their tokens, and the impact of raising a large number of chips at a low price on the secondary market will likely be fatal. On the current situation, in addition to bendao project side rely on ifo financing have profits, only big miners store eth digging to buy have profits. Other investors holding bend are basically in a floating loss state. In the case of a large number of investors floating losses in the early stage, and then go to the low price of financing, financing to exacerbate the circulation plate, if not a high quality resource institutions, I suggest to consider the secondary market and bend community shareholders confidence in the blow, after all, bend daily buy and in doing liquidity are taking the risk of bend, maintain the existing price of bend, they are also benddao shareholders, The core interests of these shareholders cannot be ignored. No matter who you sell the token financing to, they are out for profit and this price inequality will likely cause a split in the community.

As the nft market grows, the nft blue chip share is expected to continue to grow, and if there is to be bad debt, it can likely exceed $8 million in the future, so the practice of trying to intervene in the market with a small, limited amount of money is, in my opinion, of limited effect. But a low finance bend scheme of 10% of the total is very damaging to the market. There is also the question of whether the process is just or not which will also involve the community’s trust in DAO. Personally I don’t see the need to raise money, it’s not about the life or death of the project at the moment, but selling yourself with a low 10% share to the detriment of the majority of investors.

I personally think that this financing proposal will have a negative impact on bend until there is a consensus on the details and the target of the financing. In summary, I am opposed to this proposal.

Compared with your two proposals, I agree more with Vs01’ proposal. For the financing part, the 10% token amount is huge, and there will be great risks. At the same time, $8 million is not equal to the largest NFTFi platform. We need to maintain enough confidence in the value of the platform. The current market does not give VCs a way to obtain a large number of Bend tokens. This financing will be their only bet on BendDAO. , and the popularity of NFTFi has never really exploded. I believe that many VCs have been paying attention to bend. We need VCs with enough strength to invest, and they need to help improve the liquidity of tokens. In this interest-driven market , the price of the token directly determines the supply and demand of the platform, and if they cannot help this, financing will lose a lot of meaning. I am also opposed to this proposal, but as a DAO member, I am grateful that Guo is moving forward

在您对Vs01.eth回复中,我看您自己都不持有bend代币,是没办法代表Vbend用户的利益角度去思考问题,还有说到您不代表BendDao项目的人,回复中您用“我们”代表了去接触vc,对您的回复我表示前后矛盾,对您的提案出发点产生质疑。

而且低价出售Bend,在币价浮亏百分90情况下对持有Bend的用户是极大的伤害,更别说Vbend持有者,其中Vs01.eth发表的意见我是表示赞同的,800w美金低价融资对BendDao来说断送前程,对BendDao协议来说您的附加值也会让买Bend的人失去信心,对Bend用户的共识造成分裂和社区产生负面影响,拒绝提案发起。

In your reply, I see that you do not hold bend tokens, so you are not in a position to think in terms of representing the interests of Vbend holders. And that you do not represent the people from the BendDao project. I question the starting point of your proposal.

And selling Bend at a low price, with a 90 percent loss on the coin, would be extremely damaging to Bend holders, not to mention Vbend holders. I agree with the comments made by Vs01.eth, that the $8 million with a low funding price would be a death knell for BendDao. Your added value to the BendDao agreement would damage the confidence of those who bought Bend. I do not support this proposal, because it will have a negative impact on the Bend users and the community.

Web3 is global by natural, I suggest we use english as communication language by default and no Chinese here, if anyone can’t read english use Google translate may help.

We need to follow the english is the first language global consensus, that’s how we make web3 work, it’s hard but it’s the best way to make BendDAO community bigger.

- Vis.eth is the proposer of the proposal (Original proposal: Proposal for establish a sub-treasury named “Non-performing Assets Investment Fund”)

- I am the governance facilitator

So the reason that the starting point is incorrect because I don’t hold bend tokens is not valid

About the necessity of financing

Starting point: Due to BendDAO’s liquidity crisis(Details of the incident:BendDAO Liquidity: What happened and how it was fixed)

Why invest in BendDAO

Abstract

-Capital and Web2 talent are entering the NFT space and the NFT narrative is just beginning.

-BendDAO protocol establishes standards that belong to the NFT lending protocol

-One of the objectives of the community-sponsored financing proposal is to establish a fund for the disposal of distressed assets

-I think the valuation of BendDAO can reach $560m at this stage

-BendDAO’s future revenues are likely to be in excess of $100 million in trading fees alone

1.Why do you need depoly NFTFI sector

1.1. Current situation of NFT

The entire NFT market has recently calmed down due to the cryptocurrency bear market, but the growth has not stagnated.

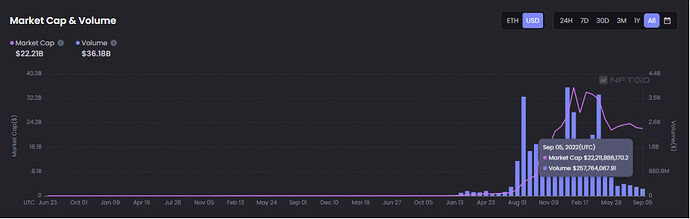

Now the daily trading volume of NFT is about 16% of the peak, but the total market capitalization of NFT has not been affected by the bear market, and has only dropped about 15% from the peak time.

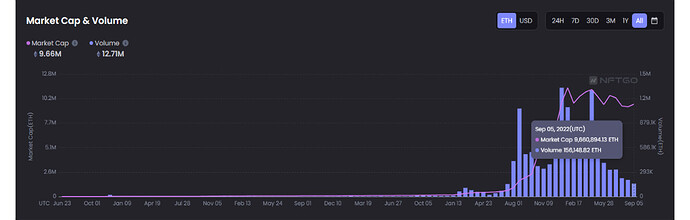

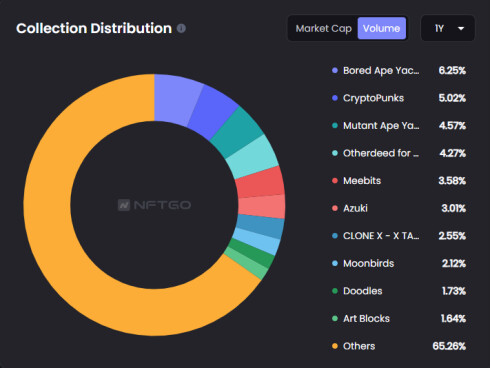

Now the total market capitalization of NFT market is about 9.6M ETH, based on today’s ETH price of $1250, the total market capitalization of NFT market in U.S. dollars is about $12B. ( Figure 1 )

Market Cap & Volume (Figure 1:From NFTGO)

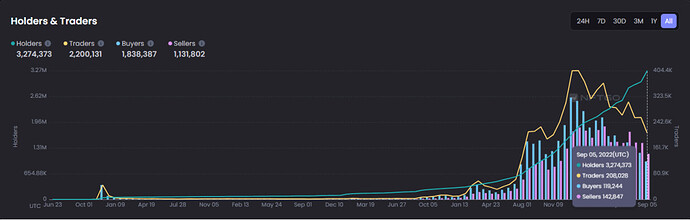

The data in Figure 2 shows that while Traders are down 50% from their peak, Holders have been steadily increasing, with about 3.2M holders as of September 22, up 10 x from 290K holders at the beginning of 2022. ( Figure 2 )

Holders & Traders (Figure2:From NFTGO)

In terms of total market cap, the entire NFT market is still at a fairly early stage relative to the $181B total market cap at the peak of DEFI (source: defillama). In terms of number of holders, the size of the future NFT, as well as the narrative, is much more grand than DEFI.

1.2. Has the development of NFT come to a halt?

Take a look at the most recent information:

NFT Collection Doodles Raises $54M at $704M Valuation

The venture-capital firm of Reddit co-founder Alexis Ohanian led the funding round.

COOL CATS GROUP APPOINTS RECUR EXECUTIVE, DISNEY VETERAN STEPHEN TEGLAS AS CEO

It is easy to see from the recent news that Capital and Web2 talent are entering the NFT space and the NFT narrative is just beginning.

1.3. The current state of the NFTFI sector

The growth of the number of users and the entry of Capital as well as talents can prove that the development of NFT has not stagnated and is an incremental market.

The NFTFI sector, meanwhile, has benefited from the rapid growth of NFT and is gradually becoming lively.

Marketplace segment , is the main market for NFT exchange, with Looksrare, X2Y2, MagicEden, CoinbaseNFT and other platforms launched one after another, breaking the monopoly of Opensea. From the NFT-related fund-raising information, Capital has long entered the Marketpalce segment.

Lending segment, a key part of improving liquidity and trading volume in NFT Marketplace, is one of the essential components of NFTFI, which is now less popular due to the bear market. if you want to cloth NFTFI, Lending segment is now a very good choice.

2. Why BENDDAO

2.1 NFT Lending segment project list

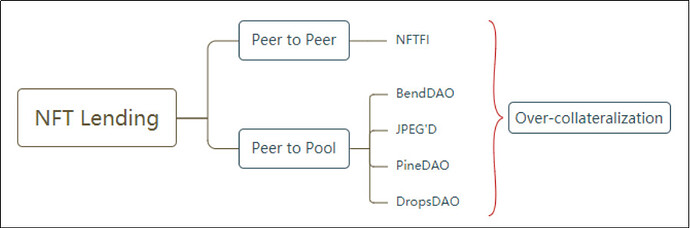

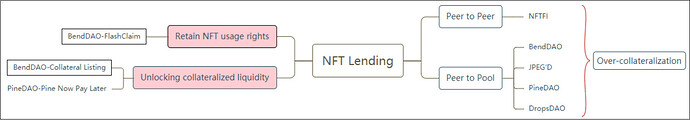

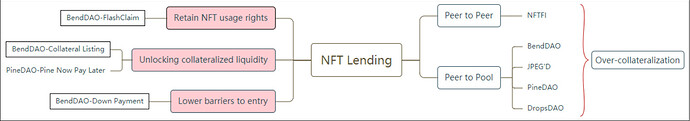

NFT Lending protocol are divided into two main categories:

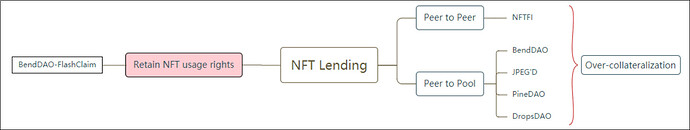

The peer-to-peer model represented by Nftfi Protocol and the peer-to-pool model represented by BENDDAO Protocol.

All adopted are the same over-collateralized lending models as AAVE or Compound.

2.2.Retaining access to NFT mortgagees

Since FT (ERC20) is fundamentally different from NFT (ERC721), the Lending Protocol is not simply a migration from ERC20.

In addition to the emphasis on ownership, NFT assets are mainly used in the right to use, so the NFT Lending Protocol needs to retain the user’s right to use the NFT to the maximum extent possible after collateralizing ownership, e.g., accepting airdrops or receiving rewards.

BendDAO takes into account the needs of NFT mortgagees and has developed the FlashClaim feature, which allows users to receive airdrops or rewards from the project after mortgaging NFT assets without having to repay the loan.

2.3.Release collateralized liquidity to inject liquidity into the NFT market

Due to the nature of NFT assets, they have been facing the dilemma of insufficient liquidity activity. This has also put the development of the NFT Lending market in a difficult position, as more and more NFT collateral is locked in the Lending market, leading to a further tightening of liquidity in the NFT market.

BendDAO developed a blue chip NFT trading market to release collateral liquidity and support the listing of collateral to address the lack of liquidity in the NFT market.

BendDAO’s blue-chip NFT marketplace is now being integrated by a growing number of NFT Marketplaces, and the liquidity released by BendDAO is making its way into the mainstream NFT market.

2.4.Lower the threshold for users to enter the NFT market

After a round of bull market in the NFT market, the price of blue-chip NFT has risen to a point where it is unaffordable for ordinary people, turning many fans away.

In order to allow more users to enter the NFT market at a lower price, BendDAO has developed a down payment purchase feature that allows users to pay only 60%-70% of the price of blue chip NFT to own blue chip NFT.

In summary, in order for the NFT lending protocol to play an active role in the development process of the NFT market, the BendDAO protocol builds on the ERC20 lending protocol and establishes standards that belong to the NFT lending protocol:

Maximize the user’s right of use ( FlashClaim );

Releasing collateral liquidity (Collateral Listing);

Lowering the threshold for users to enter NFT (Down Payment).

BendDAO’s innovations to the NFT Lending segment continue unabated, like:

Support for Rare Koda;

Adding peer-to-peer lending on the peer-to-pool.

BendDAO’s goal is to become the AAVE of NFT and go beyond it.

3. Why the community is driving this financing

3.1. Establishment of a non-performing asset disposal fund

The two liquidation crisis events of BendDAO, where the protocol had a floating loss, led to a run on depositors, and the protocol actually did not end up generating liabilities, but the negative impact was huge.

In order to address this issue, the community adjusted the liquidation parameters in the form of a proposal to reduce the probability of floating losses on the protocol.

However, in response to the “black swan” event, the community proposed to use treasury assets for raising funds and use part of the funds to establish a non-performing asset disposal fund to deal with the bad debts of the protocol.

3.2. Introduce more governance members

Since the liquidity of BEND tokens in the secondary market is not abundant enough, resulting in a high concentration of BEND tokens, in order to make the governance more decentralized, so the BendDAO community wants to introduce more governance members by way of raising funds.

3.3. Diversification of treasury assets

Diversification of treasury assets is an essential step in order to respond to future trends, and with this fund-raising, the BendDAO community hopes to establish a treasury committee to regulate the use of treasury funds.

Community participation in governance is a very positive sign.

It is recommended that the community first form a treasury council to carry out matters of financing.

4. Why I think BendDAO’s valuation should be higher

The proposed valuation of VIS.ETH is $200m, while I think the valuation of BendDAO can reach $560m at this stage.

4.1. Comparison with Major Lending Protocols

AAVE is not comparable as it sold most of its tokens during the ICO and the economic model at that time is no longer adapted to the current market.

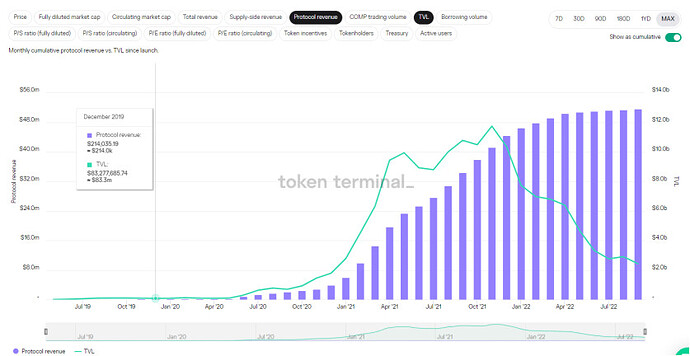

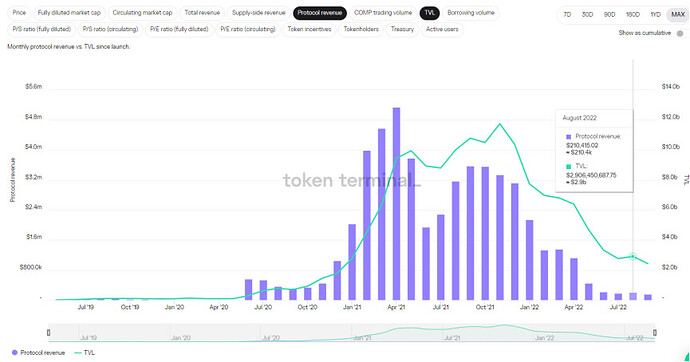

Compound received two funding rounds in 2018 & 2019 for a total of $33m, valued at $140m in 2019 based on the number of tokens allocated to investors at the 2020 of approximately 24%.

Compound’s TVL at 2019 raise is around $100m with $214k in Protocol revenue

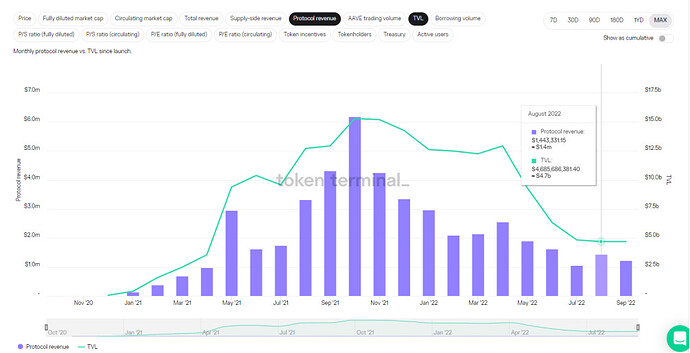

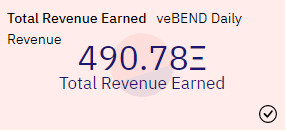

And in the last 5 months, BendDAO’s TVL is around $100m in USD terms, but the protocol revenue is 490 ETH, which is around $735k based on the last 30 days of TWAP.

BendDAO Protocol revenue

Let’s take a look at Compound’s August performance. Compound TVL for August was $2.9b, with an Protocol revenue of $210.4k.

BendDAO’s August performance was around $100M in TVL, but with 112 ETH in protocol revenue, which translates to around $181k in USD at the last 30 days of TWAP.

Compound TVL for August was $2.9b, with an Protocol revenue of $210.4k

AAVE also underperformed BendDAO in August, with a TVL of about $4.7b, generating only $1.4m in protocol revenue.

AAVE TVL for August was $4.7b, with an Protocol revenue of $1.4m

It can be seen that BendDAO is more profitable for the same TVL. Also at the beginning of the protocol development, BendDAO is 8 x more profitable than Compound.

In terms of TVL and protocol revenue for August, BendDAO is 25 x more profitable than Compound and 6 x more profitable than AAVE for the same TVL, but of course just 1 month’s data does not represent everything.

4.2. BendDAO’s revenue sources

Protocol revenue of BendDAO at this stage.

Interest income

As with other lending protocols, the main source of income for BendDAO at this stage is interest income. 30% of the interest paid by the borrower at the protocol interest rate is part of the protocol income and is allocated to veBEND holders.

Blue chip NFT market trading fees

The fee is 1% for down payment purchases and 2% for full payment purchases. 50% is deposited into the treasury and 50% is paid to the veBEND holder.

In summary, in the same bear market scenario, and at the same early stage of the project, Compound is valued at $140m in early 2019. at the same TVL, BendDAO is 8x more profitable than Compound over the same period, but of course there are many factors affecting profitability, so I ended up setting profitability conservatively at 4x, and then using $ 140m valuation X 4, resulting in a valuation of $560m for BendDAO at this stage.

5. Why investing in BendDAO can pay off handsomely

5.1. NFTFI Lego Components

BendDAO is now being integrated by NFT Marketplace with the following features:

Lending and down payment purchase, used by Marketplace as a financial tool;

Collateral listing, which is providing liquidity to the Marketplace.

5.2. Instant Liquidity

BendDAO has developed a new type of financial by combining lending and collateral listing: instant liquidity.

Instant liquidity will enable the complete migration of blue-chip NFT trading to BendDAO. Users selling blue-chip NFT through BendDAO will immediately receive a portion of the prepaid ETH until the NFT is sold and the final payment is settled.

Instant liquidity will be widely available when the liquidity of BendDAO’s blue chip NFT market is integrated with other Marketplaces.

5.3. How the BendDAO protocol’s revenues are growing

The two main sources of revenue for the BendDAO protocol are.

Interest income:

Peer-to-pool lending + peer-to-peer lending;

Support more blue chip NFTs.

The total market capitalization of NFT is now around $22.2b, and BendDAO has generated around $735k in revenue for the protocol in 5 months, which gives an annual revenue of around $1.7m. If the NFT market grows by 10x or 100x and the demand for lending increases, theoretically BendDAO’s revenue from the protocol will also grow in parallel.

The total market capitalization of NFT is now around $22.2b

Since BendDAO has only recently completed the whole eco-close loop, i.e.: purchase of NFT - collateralized lending - collateralized liquidity release - collateralized liquidity listing. So now the collateralized blue chip NFT in BendDAO only accounts for 3% of the total, and there is still very much room for growth.

Trading fee income:

Liquidity on collateral listings being consolidated by more markets;

Instant Liquidity Makes Blue Chip NFT Trading Migrate to BendDAO.

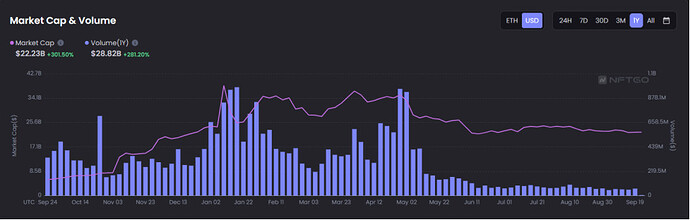

Over the past year, the overall NFT market volume was approximately $28.82b.

Over the past year, the overall NFT market volume was approximately $28.82b.

Blue chip NFTs trade 35% of the overall NFT trading volume.

Blue chip NFTs trade 35% of the overall NFT trading volume.

If 50% of that volume migrates to BendDAO, then the 2% fee annual revenue is about 28.82b X 50% X 35% X 2% = $100m.

These are the reasons why you should invest in BendDAO!

This is purely a personal and subjective view of BENDDAO, and as a member of the BendDAO community, it is my duty to introduce benddao to you.

Data Citation: NFTGO,Tokenterminal

I agree with you that a reasonable valuation is good for the development of the project.

bro you can make it a medium or mirror article lol, it’s so well written.

I think we need committee for DAO treasury, no one can represent BendDAO to sell token without veBend election.

Great article, data says everything!

In my opinion, I think now is not the time for us to price the protocol at a high price, We should prioritize finding more external partners like blue chip markets and established VCs, … they will be the fulcrum for our protocol to be stronger. Because of the fact that we are still too small and ready to be replaced by other lending protocols at any time

One of the things I think, we have to be most systematic about, is Fundraising will bring the following great benefits;

1 - Raising capital through funds and partners: In addition to having more available capital, it also helps us to expand and develop the market, get support and promotion by many people.

2- Our platform is still facing many big risks and especially the liquidity of $Bend, we are still using $bent to pay, but centralized exchanges that support good liquidity are not If we connect more centralized exchanges, we will be less worried about interest rate fluctuations.

3- As we raise more funds, we will gradually become more decentralized, because in my judgment our protocol is still quite centralized because of the amount of $bent held by a lot of people. few people.

Victor-M

How to avoid being betrayed by these funds

Which funds are you referring to betrayal?

Maybe I’m using the wrong word, I mean the introduction of capital is good for the whole ecology, but we also need to discuss how to restrict capital to protect ordinary vbend holders

Yes, I agree with your idea.

But i think we should build financing group first.

With all due respect, I ask you to preside over the new vote and discussion so that the bentdao protocol can be developed and expanded, Since the potential of the NFT lending market is huge and what we working is still very small, below is the article related to real estate via NFT that was posted yesterday. And we can completely expand into this area with markets like decentraland and sandbox,…No matter what NFTs are valuable in the future … Readers can refer to more at

Sorry for my poor English, so if I can’t express it clearly, please forgive me.

I need to wait for codeincoffee to push for the BendDAO Commity committee proposal first

BendDAO dev team account will make a post about it, team internal make decision and team account to make post, my account will only for my personal opinion, that’s a good way to decentralization.