Why invest in BendDAO

Abstract

-Capital and Web2 talent are entering the NFT space and the NFT narrative is just beginning.

-BendDAO protocol establishes standards that belong to the NFT lending protocol

-One of the objectives of the community-sponsored financing proposal is to establish a fund for the disposal of distressed assets

-I think the valuation of BendDAO can reach $560m at this stage

-BendDAO’s future revenues are likely to be in excess of $100 million in trading fees alone

1.Why do you need depoly NFTFI sector

1.1. Current situation of NFT

The entire NFT market has recently calmed down due to the cryptocurrency bear market, but the growth has not stagnated.

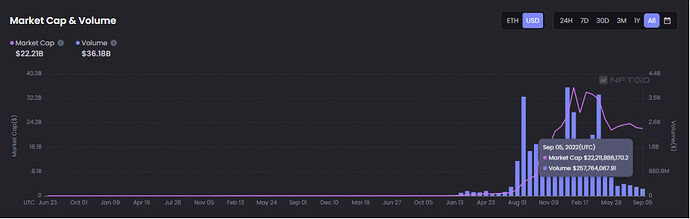

Now the daily trading volume of NFT is about 16% of the peak, but the total market capitalization of NFT has not been affected by the bear market, and has only dropped about 15% from the peak time.

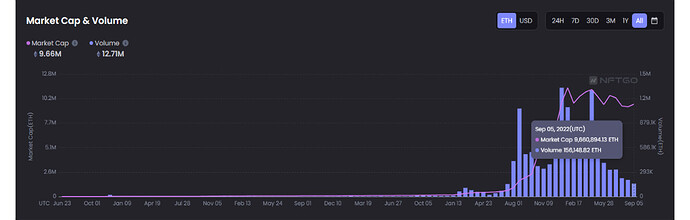

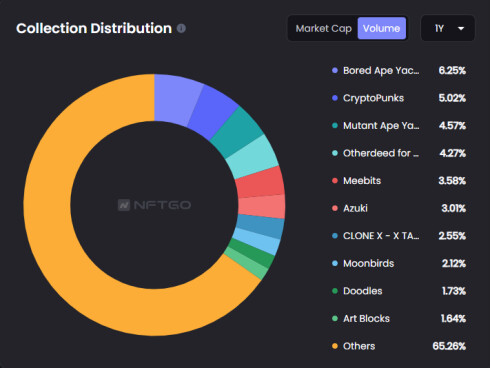

Now the total market capitalization of NFT market is about 9.6M ETH, based on today’s ETH price of $1250, the total market capitalization of NFT market in U.S. dollars is about $12B. ( Figure 1 )

Market Cap & Volume (Figure 1:From NFTGO)

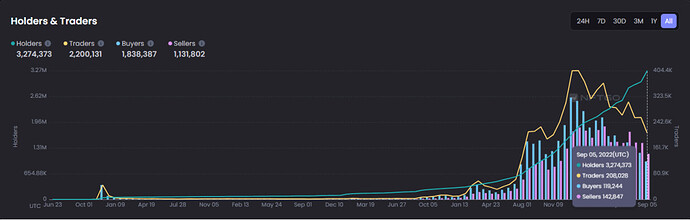

The data in Figure 2 shows that while Traders are down 50% from their peak, Holders have been steadily increasing, with about 3.2M holders as of September 22, up 10 x from 290K holders at the beginning of 2022. ( Figure 2 )

Holders & Traders (Figure2:From NFTGO)

In terms of total market cap, the entire NFT market is still at a fairly early stage relative to the $181B total market cap at the peak of DEFI (source: defillama). In terms of number of holders, the size of the future NFT, as well as the narrative, is much more grand than DEFI.

1.2. Has the development of NFT come to a halt?

Take a look at the most recent information:

NFT Collection Doodles Raises $54M at $704M Valuation

The venture-capital firm of Reddit co-founder Alexis Ohanian led the funding round.

COOL CATS GROUP APPOINTS RECUR EXECUTIVE, DISNEY VETERAN STEPHEN TEGLAS AS CEO

It is easy to see from the recent news that Capital and Web2 talent are entering the NFT space and the NFT narrative is just beginning.

1.3. The current state of the NFTFI sector

The growth of the number of users and the entry of Capital as well as talents can prove that the development of NFT has not stagnated and is an incremental market.

The NFTFI sector, meanwhile, has benefited from the rapid growth of NFT and is gradually becoming lively.

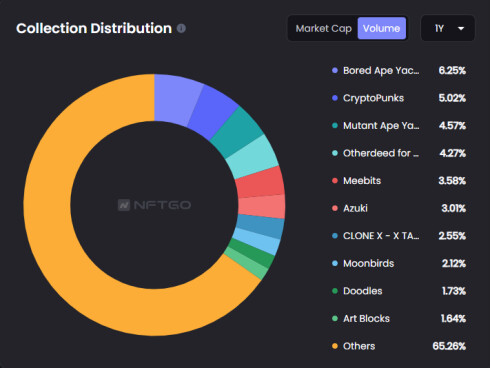

Marketplace segment , is the main market for NFT exchange, with Looksrare, X2Y2, MagicEden, CoinbaseNFT and other platforms launched one after another, breaking the monopoly of Opensea. From the NFT-related fund-raising information, Capital has long entered the Marketpalce segment.

Lending segment, a key part of improving liquidity and trading volume in NFT Marketplace, is one of the essential components of NFTFI, which is now less popular due to the bear market. if you want to cloth NFTFI, Lending segment is now a very good choice.

2. Why BENDDAO

2.1 NFT Lending segment project list

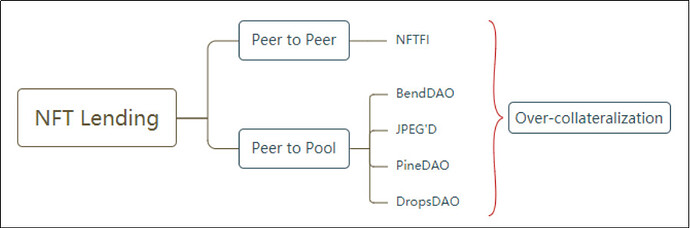

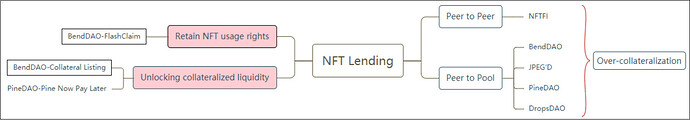

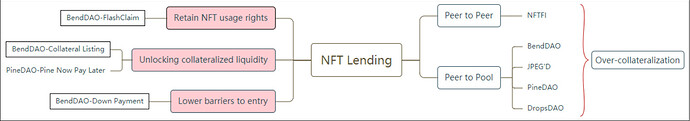

NFT Lending protocol are divided into two main categories:

The peer-to-peer model represented by Nftfi Protocol and the peer-to-pool model represented by BENDDAO Protocol.

All adopted are the same over-collateralized lending models as AAVE or Compound.

2.2.Retaining access to NFT mortgagees

Since FT (ERC20) is fundamentally different from NFT (ERC721), the Lending Protocol is not simply a migration from ERC20.

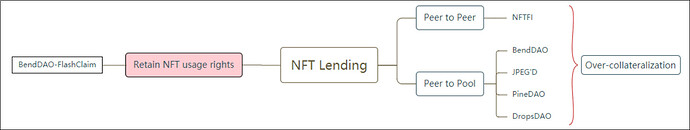

In addition to the emphasis on ownership, NFT assets are mainly used in the right to use, so the NFT Lending Protocol needs to retain the user’s right to use the NFT to the maximum extent possible after collateralizing ownership, e.g., accepting airdrops or receiving rewards.

BendDAO takes into account the needs of NFT mortgagees and has developed the FlashClaim feature, which allows users to receive airdrops or rewards from the project after mortgaging NFT assets without having to repay the loan.

2.3.Release collateralized liquidity to inject liquidity into the NFT market

Due to the nature of NFT assets, they have been facing the dilemma of insufficient liquidity activity. This has also put the development of the NFT Lending market in a difficult position, as more and more NFT collateral is locked in the Lending market, leading to a further tightening of liquidity in the NFT market.

BendDAO developed a blue chip NFT trading market to release collateral liquidity and support the listing of collateral to address the lack of liquidity in the NFT market.

BendDAO’s blue-chip NFT marketplace is now being integrated by a growing number of NFT Marketplaces, and the liquidity released by BendDAO is making its way into the mainstream NFT market.

2.4.Lower the threshold for users to enter the NFT market

After a round of bull market in the NFT market, the price of blue-chip NFT has risen to a point where it is unaffordable for ordinary people, turning many fans away.

In order to allow more users to enter the NFT market at a lower price, BendDAO has developed a down payment purchase feature that allows users to pay only 60%-70% of the price of blue chip NFT to own blue chip NFT.

In summary, in order for the NFT lending protocol to play an active role in the development process of the NFT market, the BendDAO protocol builds on the ERC20 lending protocol and establishes standards that belong to the NFT lending protocol:

Maximize the user’s right of use ( FlashClaim );

Releasing collateral liquidity (Collateral Listing);

Lowering the threshold for users to enter NFT (Down Payment).

BendDAO’s innovations to the NFT Lending segment continue unabated, like:

Support for Rare Koda;

Adding peer-to-peer lending on the peer-to-pool.

BendDAO’s goal is to become the AAVE of NFT and go beyond it.

3. Why the community is driving this financing

3.1. Establishment of a non-performing asset disposal fund

The two liquidation crisis events of BendDAO, where the protocol had a floating loss, led to a run on depositors, and the protocol actually did not end up generating liabilities, but the negative impact was huge.

In order to address this issue, the community adjusted the liquidation parameters in the form of a proposal to reduce the probability of floating losses on the protocol.

However, in response to the “black swan” event, the community proposed to use treasury assets for raising funds and use part of the funds to establish a non-performing asset disposal fund to deal with the bad debts of the protocol.

3.2. Introduce more governance members

Since the liquidity of BEND tokens in the secondary market is not abundant enough, resulting in a high concentration of BEND tokens, in order to make the governance more decentralized, so the BendDAO community wants to introduce more governance members by way of raising funds.

3.3. Diversification of treasury assets

Diversification of treasury assets is an essential step in order to respond to future trends, and with this fund-raising, the BendDAO community hopes to establish a treasury committee to regulate the use of treasury funds.

Community participation in governance is a very positive sign.

It is recommended that the community first form a treasury council to carry out matters of financing.

4. Why I think BendDAO’s valuation should be higher

The proposed valuation of VIS.ETH is $200m, while I think the valuation of BendDAO can reach $560m at this stage.

4.1. Comparison with Major Lending Protocols

AAVE is not comparable as it sold most of its tokens during the ICO and the economic model at that time is no longer adapted to the current market.

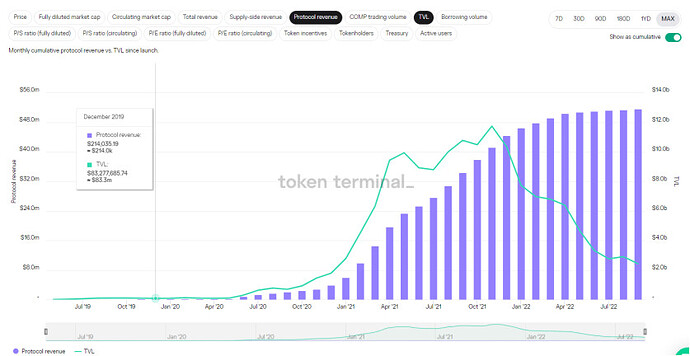

Compound received two funding rounds in 2018 & 2019 for a total of $33m, valued at $140m in 2019 based on the number of tokens allocated to investors at the 2020 of approximately 24%.

Compound’s TVL at 2019 raise is around $100m with $214k in Protocol revenue

And in the last 5 months, BendDAO’s TVL is around $100m in USD terms, but the protocol revenue is 490 ETH, which is around $735k based on the last 30 days of TWAP.

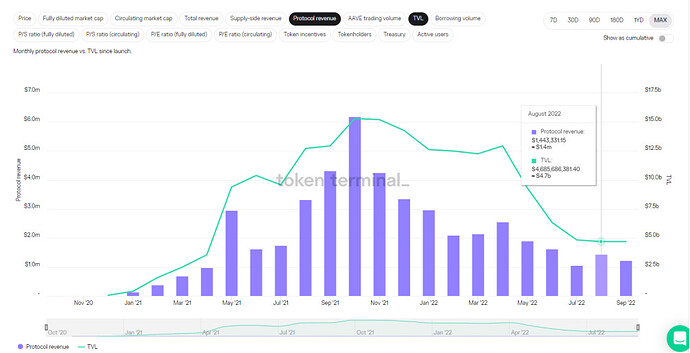

BendDAO Protocol revenue

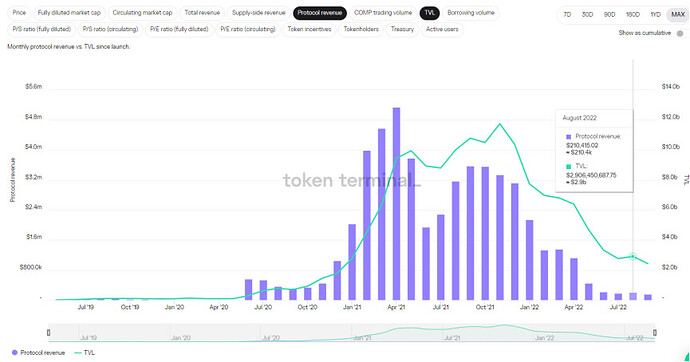

Let’s take a look at Compound’s August performance. Compound TVL for August was $2.9b, with an Protocol revenue of $210.4k.

BendDAO’s August performance was around $100M in TVL, but with 112 ETH in protocol revenue, which translates to around $181k in USD at the last 30 days of TWAP.

Compound TVL for August was $2.9b, with an Protocol revenue of $210.4k

AAVE also underperformed BendDAO in August, with a TVL of about $4.7b, generating only $1.4m in protocol revenue.

AAVE TVL for August was $4.7b, with an Protocol revenue of $1.4m

It can be seen that BendDAO is more profitable for the same TVL. Also at the beginning of the protocol development, BendDAO is 8 x more profitable than Compound.

In terms of TVL and protocol revenue for August, BendDAO is 25 x more profitable than Compound and 6 x more profitable than AAVE for the same TVL, but of course just 1 month’s data does not represent everything.

4.2. BendDAO’s revenue sources

Protocol revenue of BendDAO at this stage.

Interest income

As with other lending protocols, the main source of income for BendDAO at this stage is interest income. 30% of the interest paid by the borrower at the protocol interest rate is part of the protocol income and is allocated to veBEND holders.

Blue chip NFT market trading fees

The fee is 1% for down payment purchases and 2% for full payment purchases. 50% is deposited into the treasury and 50% is paid to the veBEND holder.

In summary, in the same bear market scenario, and at the same early stage of the project, Compound is valued at $140m in early 2019. at the same TVL, BendDAO is 8x more profitable than Compound over the same period, but of course there are many factors affecting profitability, so I ended up setting profitability conservatively at 4x, and then using $ 140m valuation X 4, resulting in a valuation of $560m for BendDAO at this stage.

5. Why investing in BendDAO can pay off handsomely

5.1. NFTFI Lego Components

BendDAO is now being integrated by NFT Marketplace with the following features:

Lending and down payment purchase, used by Marketplace as a financial tool;

Collateral listing, which is providing liquidity to the Marketplace.

5.2. Instant Liquidity

BendDAO has developed a new type of financial by combining lending and collateral listing: instant liquidity.

Instant liquidity will enable the complete migration of blue-chip NFT trading to BendDAO. Users selling blue-chip NFT through BendDAO will immediately receive a portion of the prepaid ETH until the NFT is sold and the final payment is settled.

Instant liquidity will be widely available when the liquidity of BendDAO’s blue chip NFT market is integrated with other Marketplaces.

5.3. How the BendDAO protocol’s revenues are growing

The two main sources of revenue for the BendDAO protocol are.

Interest income:

Peer-to-pool lending + peer-to-peer lending;

Support more blue chip NFTs.

The total market capitalization of NFT is now around $22.2b, and BendDAO has generated around $735k in revenue for the protocol in 5 months, which gives an annual revenue of around $1.7m. If the NFT market grows by 10x or 100x and the demand for lending increases, theoretically BendDAO’s revenue from the protocol will also grow in parallel.

The total market capitalization of NFT is now around $22.2b

Since BendDAO has only recently completed the whole eco-close loop, i.e.: purchase of NFT - collateralized lending - collateralized liquidity release - collateralized liquidity listing. So now the collateralized blue chip NFT in BendDAO only accounts for 3% of the total, and there is still very much room for growth.

Trading fee income:

Liquidity on collateral listings being consolidated by more markets;

Instant Liquidity Makes Blue Chip NFT Trading Migrate to BendDAO.

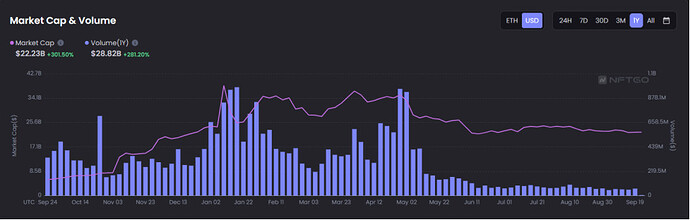

Over the past year, the overall NFT market volume was approximately $28.82b.

Over the past year, the overall NFT market volume was approximately $28.82b.

Blue chip NFTs trade 35% of the overall NFT trading volume.

Blue chip NFTs trade 35% of the overall NFT trading volume.

If 50% of that volume migrates to BendDAO, then the 2% fee annual revenue is about 28.82b X 50% X 35% X 2% = $100m.

These are the reasons why you should invest in BendDAO!

This is purely a personal and subjective view of BENDDAO, and as a member of the BendDAO community, it is my duty to introduce benddao to you.

Data Citation: NFTGO,Tokenterminal