Summary

BendDAO has been safely running on mainnet for more than 6 months. The on-chain stats and community support show that BendDAO is a product-market fit that provides what NFT communities want and need. The core team would like to summarize the future plan and the response to the proposals in the forum.

Background

BendDAO is leading the NFT lending market in terms of TVL. The BendDAO core team has been building the protocol since last September. The first line of BendDAO codes was created in September 2021. BendDAO was launched on testnet when auditing. The mainnet launch happened when Certik issued the first version of the BendDAO lending protocol audit report in March 2022. Verilog issued the second audit report in May 2022.

BendDAO is functional before the Initial Fair-launch Offering (IFO) BendDAO Fair Launch. BendDAO is a fair-launched DAO with… | by BendDAO | Sep, 2022 | Medium . And the current roadmap is the action plan of the core team.

Specification

Protocol Development

BendDAO aims to provide better liquidity for the NFT market and will keep working towards this mission. All features are designed to facilitate the NFT liquidity while ensuring infrastructure can scale in line with ecosystem growth.

Milestones achieved

- Peer-to-pool NFT lending

- Flash claim

- Down payment

- Collateral listing

To-do list

- ApeCoin staking with the flash claim

- Moonbirds in nesting integration

- Wrapper Koda for Otherdeeds

- Price offer

- P2P NFT lending

- Open API and SDK

Roadmap: Roadmap - Portal

DAO Treasury Council

The community will lead future development after the delivery of all planned functionalities which can be called BendDAO v1. Transparency builds trust. BendDAO is a DAO with 100% transparency. The DAO Treasury Council will be directly elected by veBEND holders as a legitimate form of establishment. The primary mandate of the Council is to provide resources for the growth and expansion of the protocol.

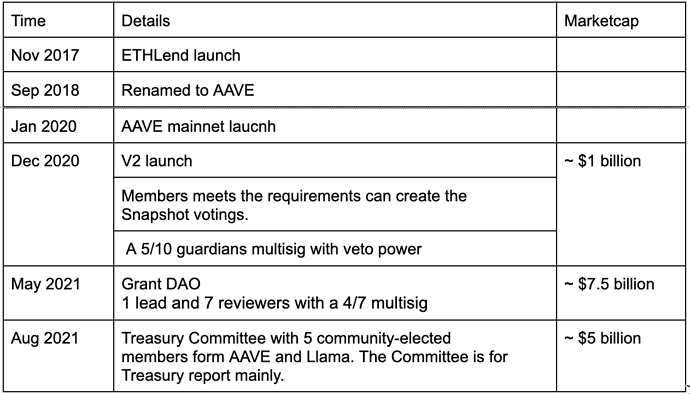

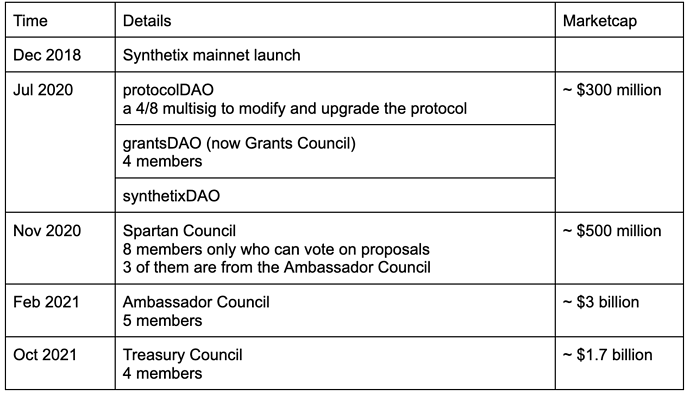

BendDAO governance structure will be set up based on community discussion with reference to famous DAOs, e.g, AAVE, Synthetics, and ApeCoin. Before the form of the DAO Treasury Council, no individual is legitimate to represent BendDAO to negotiate funding terms and sell tokens.

DAO Treasury Multisig

The DAO Treasury Multisig will be a step further by making governance powers discrete under the direct control of veBEND holders. Every treasury transaction in a smart contract needs approval from a certain number of signers. The Multisig is tasked with executing the decisions made by veBEND holders and with ‘veto power’ to request further review of the BIP.

A set of candidates who are experienced in DeFi will be invited to help BendDAO connect with the ecosystem. All processes will be transparent in the forum.

Next step

Considering the early stage of BendDAO and the macroeconomic conditions, it’s not a suitable time to start to form the DAO Treasury Council and the Treasury Multisig. The core team should focus on protocol development to grow the community and raise awareness at the current stage. The fundraising-related proposals will be handled by the DAO Treasury Council in the future. All treasury-related transactions will be executed by the DAO Treasury Multisig.